INTEGRATION

ACCOUNTS

TRANSACTION ASSURANCE

CHARGES

REPORTS

DISPUTES & FRAUD

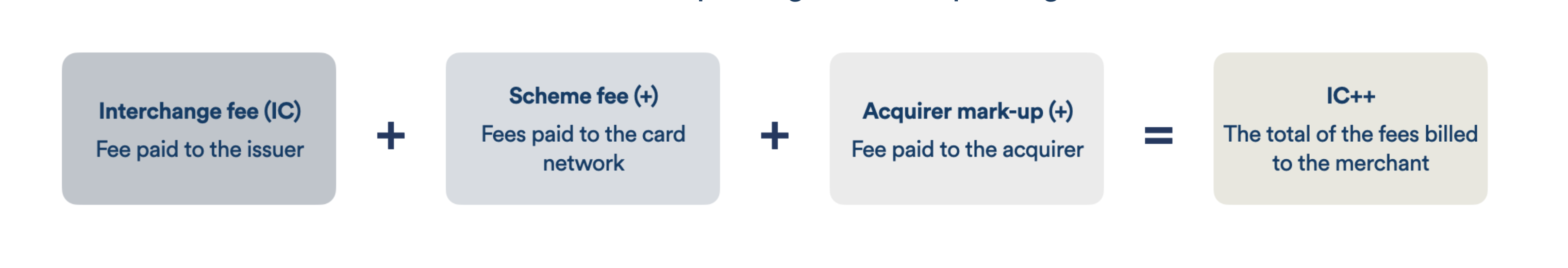

Interchange & Scheme Fees

The fee endpoints allow for estimations of the interchange and scheme fees that apply to a charge. These endpoints estimate the total cost of a charge before submitting it for authentication, authorization, and clearing. These endpoints return these fees applicable to the charge in their format, and both rely on the same minimal set of input parameters to get the most accurate estimation. Therefore, the merchant acceptor, transaction type, and 3DS usage are requested. These endpoints can receive indicative interchange and scheme fees applied to an indicative transaction. This information can then determine merchant pricing for IC++ pricing models.

The estimate may be inaccurate due to any of the following reasons:

Graduated products

Authorization fallbacks

Foreign exchange rate dates

The selected interchange program is surfaced in the API response in the designator field which is not scheme agnostic and will return different sub-fields for Visa feeDescriptor and Mastercard ird. More information on the fee programs can be found in the interchange manuals of the respective schemes.

Fee Components and Amount

The API endpoint will return the total interchange fee amount in the amount field and this information should be sufficient for interchange fee estimation. All individual fee components will be returned in a segments structure containing the elements used in calculating the total amount. This could consist of a fixed component as well as a variable component. The variable component might be capped.

fixed: Fixed component of the interchange fee in minor unitsbasisPoints: Variable component of the interchange fee in basis points (0.01%)max: Maximum fee amount in minor units; fee capped at this amount even if the transaction amount is highermin: Minimum fee amount in minor units; the fee will not be lower even if the transaction amount is lower

You are advised to use the amount field where all this logic has already been applied. These elements are returned to give a complete picture of the interchange fee's inner workings and allow for the reconstruction of the interchange fee.

Currency Conversion

The fee components are not necessarily in the same currency as the transaction currency, but the fee service takes care of this conversion to simplify the usage of this endpoint. The currency conversion rates are sourced from the card scheme rate tables, which are published and updated daily. The version of the used rate table file is returned in feeDate.

The amount is always in the transaction currency, and the conversion rates used are listed in the rates structure, which contains all the necessary elements to reconstruct the conversion operation.

Example Estimate Interchange Request

Example Estimate Interchange Response

Scheme fees are determined and directly charged by the different card networks. Scheme fees are updated periodically over time. The fees are a combination of transaction-related elements, such as 3DS authentication and authorization fees, and fixed fees, such as subscriptions to certain card network services. Scheme fees can be charged on a fixed amount per transaction or as a % of the transaction amount and have varying billing periods ranging from weekly, monthly, quarterly, to annually. Some scheme fees are applied per transaction, while others are used at an acquirer level. Specific scheme fees may also be adjusted as card schemes initially charge fees based on the acquirer country but then adjust the fees to reflect merchant country pricing at the end of each quarter.

We provide estimated scheme fees on a per-transaction basis using our proprietary scheme fee pricing model, which is based on hundreds of rules triggered by transaction characteristics such as transaction jurisdiction, transaction amount, and authentication performed.

Our scheme fee model is frequently updated based on card scheme bulletins and releases. Our scheme fee reports are designed to support an IC++ pricing model and allow reconciliation with scheme fee billing invoices received.

The Estimate Scheme Fee endpoint will perform a scheme fee estimation, returning a list of predicted scheme fees when passing some parameters similar to a charge. These scheme fees can be either a fixed or basisPoints scheme fee and contain a calculated amount based on the input amount and the scheme fee amount. See the example request:

Example Scheme Fee Response

This endpoint is still under development; it has a limited library of scheme fees and will not provide fee estimates for all supported card networks.